what is a quarterly tax provision

ASC 740 requires companies to account for income tax rate and law changes in the period in which the law is enacted. Recent editions appear below.

Income Tax Computation For Corporate Taxpayers Prepared By

Fourth quarter payments are due January 15 of the following year.

. The IRS expects tax payments to be made quarterly to cover income thats been made in the previous three months. Negative ETR due to withholding taxes orand naked credit tax effects Jurisdictions for which a reliable estimate cannot be made Exception Two Recognize a tax expense benefit for the year -to-date ordinary income loss as if a tax return were filed on the year-to-date income loss discrete calculation. Individuals and organizations including the AICPA have criticized a corporate minimum tax based on financial statement or book income.

The tax provision is typically the most scrutinized process that the tax department undertakes. The following flowchart details the tax process in Tax Provision. An individual who expects to owe less than 1000 in taxes after subtracting federal income tax is exempt from quarterly tax payments.

In normal years these are the due dates. As a freelancer single business owner or independent worker taxes can get a bit tricky. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense.

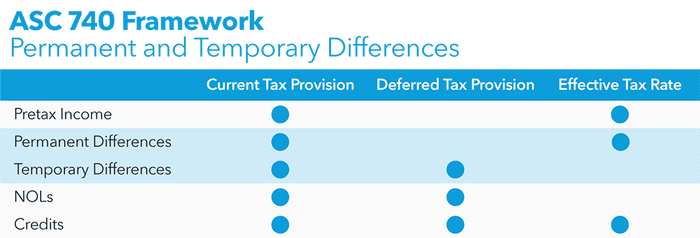

The amount of this provision is derived by adjusting the reported net income of a business with a variety of permanent differences and temporary differences. The first quarter is due on April 15. Most financial statement processes can be optimized over time by adding incremental improvements each month.

Instead of waiting for the traditional tax season during the months of March and April its in your best interest to pay the government in periodic payments. A tax provision is the estimated amount that your business is expected to pay in state and federal taxes for the current year. The global provision process starts at the legal entity level in the desired reporting standard for example US GAAP IFRS UK GAAP and local currency.

A 100 million threshold would apply to certain foreign-parented corporations. Companies may encounter state tax law changes that impact the income tax provision. Additionally if your federal tax withholdings equal 90 or more of what you will owe for the year you probably wont need to file quarterly taxes.

Instead of waiting for the traditional tax season during the months of March and April its in. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation. Provision workpapers will commonly show your current provision deferred provision rate reconciliation state provision etc.

Tax Provision Process The Tax Provision process enables you to prepare a full tax provision based on year-to-date numbers. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. While a provision is a financial burden it also offers important protections.

Youll want as precise an estimate as possible for your provisions but may also want to set aside a small buffer amount. 16343 Interim provisionincome from equity method investments. What is a quarterly tax provision Wednesday February 16 2022 For each employee the following information is required.

What is a tax provision. A update control objectives and assertions during the year and b review for compliance with all applicable requirements at year-end or quarter-end. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

This issue discusses several important tax developments and related ASC 740 considerations. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are recognized through the use of an estimated annual effective tax rate applied to measures of year-to-date operating results referred to as ordinary income or loss and specific events. These taxes will consist of the federal income Security and Medicare taxes withheld from employees paychecks.

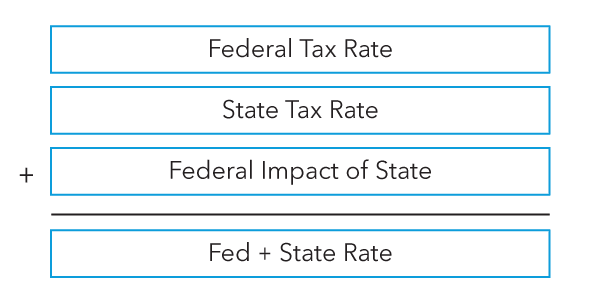

The ASC 740 income tax provision consists of current and deferred income tax expense. Estimated Annual Taxes. Divide your estimated total tax into quarterly payments.

An income tax provision is the income tax expense that will be reported on the companies financial statements. This includes federal state local and foreign income taxes. Topics covered in this edition.

An income tax provision represents the reporting periods total income tax expense. Quarterly Hot Topics is live. What you need to look at is the current provision.

The third quarter is due on September 15. The provision which would apply to an estimated 200 companies would be effective for tax years beginning after 2022. This mandate contains a waiver provision for employers who are unable to electronically submit employment tax.

For corporations the threshold is 500 in taxes annually. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. They are prepared in accordance with ASC 740.

The July issue of Accounting for Income Taxes. Since not every requirement will apply to every entity in every reporting period the second and third categories serve the dual purposes of helping entities. The tax provision is part of the audited financial statements and therefore it impacts the companys earnings and earnings per share.

Even if you did fill out a W-4 through your employer to withhold taxes from your paycheck you might have to pay quarterly taxes if your withholdings dont cover the smaller of 90 of your tax. Since you owe more than 1000 in taxes the estimated annual tax is what youre going to base your quarterly taxes on. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax.

All you have to do is divide that total amount into four quarterly payments youll pay to the IRS every three months. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. Please remember that this article describes the quarterly filing requirements for federal taxes.

Second quarter payments are due on June 15. The asset and liability method places emphasis on the valuation of current and deferred tax assets and liabilities. A state tax rate change will often require a company to re-price its deferred tax assets and liabilities resulting in a deferred impact on.

GAAP specifically ASC Topic 740 Income Taxes requires income taxes to be accounted for by the assetliability method. Tax rate changes in the quarter in which the law is effective Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense. The amount of income tax expense recognized for a period is the amount of income taxes.

In addition if your business is subject to excise taxes you will need to file these quarterly with Form 720.

Asc 740 State Income Tax Provision Bloomberg Tax

1 2 Entities And Taxes Covered By Asc 740

Accounting For Current Liabilities Financial Accounting

Definition Types Of Tax Liabilities Accounting Clarified

Accounting For Current Liabilities Financial Accounting

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Provision For Income Tax Definition Formula Calculation Examples

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

What Is A Tax Provision And How Can You Calculate It Upwork

2020 Deferred Tax Provision Covid 19 Grant Thornton

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics